...high of 5.4

percent from October's 4.4 percent.

Separately, the statistical bureau said agriculture producer

prices jumped 3.3 percent in November from October for a 26.9

percent year-on-year increase, up from October's 24.4 percent.

The data were likely to boost expectations that the central

bank could consider raising interest rates next week, hot on the

heels of a 25 basis point rise to 3.5 percent in November.

****************************************************************

KEY POINTS:

(change in percent) Nov Oct Nov forecast

month/month 0.7 0.4 0.4

year/year 5.4 4.4 5.0

(For full table of data...........................[nPRA001667])

- The monthly gain in the producer price index (PPI) led by a

3.0 percent increase in the price of food products and a 7.8

percent rise in oil prices.

COMMENTARY:

PETR DUFEK, ANALYST, CSOB BANK, PRAGUE

"This is a very bad number showing that the food price shock

is ongoing.

"Monetary policy is facing a dilemma of rising inflation,

which it can hardly influence, and a strong crown, which is

undoubtedly being supported by interest rate increases to climb

to new all-time highs."

HELENA HORSKA, ANALYST, RAIFFEISENBANK, PRAGUE

"Price growth is now a global phenomenon. Not even the

dramatic firming in the crown will prevent prices from rising.

The market could respond to this number by increasing

expectations about a rise in CNB (central bank) interest rates.

"In my view, the CNB is in the grip of rising inflation and

a strong crown, and it is uncertain how it will decide at its

December meeting. Should it at least try to show an effort to

rein in inflation expectations, it should raise interest rates

immediately. On the other hand, it is already too late to quell

inflation, and a further rise in interest rates could spark

renewed firming in the crown."

JAN VEJMELEK, HEAD OF ECONOMIC AND STRATEGY RESEARCH,

KOMERCNI BANKA

"Inflationary factors remain strong, even though they are

not of the monetary policy nature. We expect the CNB (central

bank) to raise interest rates next week, despite the strong

crown. In our view, the reason is the need to clamp down on

already rising inflation expectations."

MARKET REACTION:

- Crown unmoved at 26.290 per euro , slightly weaker on

the day.

BACKGROUND:

- Industrial PPI and agriculture producer prices are watched

closely by the markets as leading indicators for consumer

inflation which is targeted by the Czech central bank (CNB).

- November consumer inflation [ID:nL10470437]

[ID:nL10617049] [ID:nL1062697]

- October industrial output figures [ID:nL11393445]

- Report on last Czech c.bank rate decision [ID:nL29206268]

[ID:nPRA001631] [ID:n29679528]

LINKS:

- For further details on November producer prices and past data,

Reuters 3000 Xtra users can click on the statistical bureau's

Website:

http://www.czso.cz/eng/csu.nsf/kalendar/2004-ipc

- For LIVE Czech economic data releases, click on

- Instant Views on other Czech data [CZ/INSTANT]

- Overview of Czech macroeconomic indicators [CZ/ECI]

- Key data releases in central Europe [CEE-CONVERGENCE-WATCH]

- For Czech money markets data click on

- Czech money guide

- Czech benchmark state bond prices

- Czech forward money market rates

(Writing by Marek Petrus; editing by Tony Austin)

Keywords: CZECH PRICES/

[PRAGUE/Reuters/Finance.cz]

Elektromobilistům nastávají krušné časy. Elektromobily v mrazu ztrácejí až 40 % dojezdu a nabíjí se velmi pomalu

Elektromobilistům nastávají krušné časy. Elektromobily v mrazu ztrácejí až 40 % dojezdu a nabíjí se velmi pomalu

Test Seat Ateca: Zlaté staré časy aneb jistota v rozbouřených vodách a za dobrou cenu

Test Seat Ateca: Zlaté staré časy aneb jistota v rozbouřených vodách a za dobrou cenu

Šidit, svařovat totálky, kitovat a stáčet tachometry aneb v kůži polského autobazaru. Vyzkoušet pochybné praktiky si teď může každý

Šidit, svařovat totálky, kitovat a stáčet tachometry aneb v kůži polského autobazaru. Vyzkoušet pochybné praktiky si teď může každý

Řidiči, držte si klobouky. V nadcházejícím roce se změní řada věcí. Víme, které to budou

Řidiči, držte si klobouky. V nadcházejícím roce se změní řada věcí. Víme, které to budou

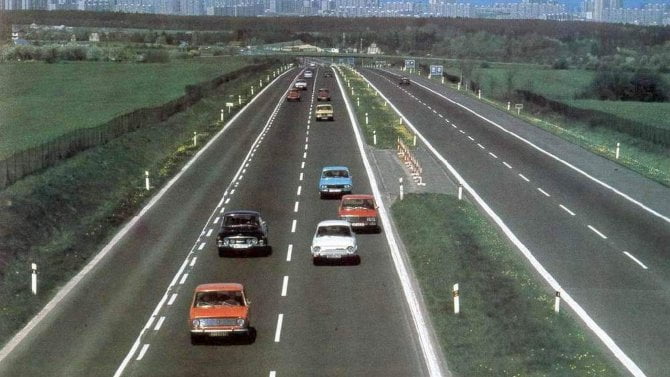

Až budete stát v koloně na D1, můžete slavit. Dálniční propojení Prahy a Bratislavy se otevřelo před 45 lety

Až budete stát v koloně na D1, můžete slavit. Dálniční propojení Prahy a Bratislavy se otevřelo před 45 lety