...six-year high

of 5.0 percent from 4.0 percent a month earlier.

Analysts said the upside surprise heightened the likelihood

that the central bank will continue tightening policy in 2008.

****************************************************************

KEY POINTS:

(pct change) Nov Oct Nov forecast

month/month 0.9 0.6 0.4

year/year 5.0 4.0 4.5

CENTRAL BANK FORECAST: The figure comes in well above the

central bank's forecast which envisaged a 3.6-4.2 percent annual

rate for November in its quarterly projection made in October.

Details of November inflation data.................[nPRA001656]

Details of November jobless data...................[nPRa001657]

- The year-on-year inflation rate is the highest since August

2001.

- The monthly gain driven by a 4.0 percent rise in food prices,

the sharpest increase since January 1993.

- Fuel prices up 2.9 percent month-on-month.

- Prices for alcohol and tobacco up 0.8 percent on the back of a

2.8 percent rise in beer prices and a 0.6 percent increase in

tobacco products prices.

COMMENTARY:

MICHAL BROZKA, ANALYST, RAIFFEISENBANK, PRAGUE

"Inflation at the start of next year will be in the

6-percent area. The CNB (central bank) cannot do anything about

that. There is a concern about a potential rise in inflation

expectations. So interest rates are still heading higher for

now, but given the present strength of the crown the CNB may

wait with an interest rate rise until next year."

RADOMIR JAC, CHIEF ANALYST, PPF ASSET MANAGEMENT

"The entire surprise comes from the food. If the step (a

rate hike by the central bank in November) was pre-emptive, they

would not have to react to it straight away.

"However, this of course shows that although the crown is

still at stronger levels, we will see a further rise (in

interest rates). But I would bet it will come in the next year."

DAVID MAREK, CHIEF ECONOMIST, PATRIA FINANCE, PRAGUE

"The entire inflation story is primarily about food prices.

It is an issue that is outside of the reach of monetary policy

of the Czech central bank, but there is a risk that the high

inflation will spill over into inflation expectations, so at the

moment it is too early to raise interest rates again, but in any

case monetary policy cannot do without further tightening.

"The urgency for further rate hikes has increased, inflation

is a lot higher than expected, but on the other hand there is

still the strong crown and its overshooting is so significant

that it will not allow (the central bank) to hike rates again

this year. We are sticking to our scenario of (a rate hike) in

the first quarter of next year."

PETR DUFEK, ANALYST, CSOB BANK, PRAGUE

"This is a much poorer number than the market had expected.

The year-on-year rate is 1.1 percentage points above the latest

CNB (central bank) forecast. Our expectations were pessimistic,

however food prices grew significantly faster than expected.

"From the central bank's point of view, today's number is a

confirmation of the path towards monetary policy tightening,

which however needs to be very deliberate given the (firm)

crown."

MARKET REACTION:

- Crown rises to a new lifetime high of 26.060 per euro

, beyond the previous all-time peak of 26.070 set last

week. Short-dated forward-looking money market rates (FRA)

gain as much as 11 basis points across the curve.

BACKGROUND:

- The central bank increased the key two-week repo rate by 25

basis points to 3.50 percent in November.

- Report on last Czech c.bank rate decision [ID:nL29206268]

[ID:nPRA001631] [ID:n29679528]

- The central bank (CNB) targets headline inflation which it

seeks to keep at 3 percent year-on-year, allowing for

fluctuations by plus/minus one percentage point from this level.

- The CNB's quarterly prediction sees consumer prices rising

4.4-5.8 percent year-on-year in September 2008 and 3.1-4.5

percent in March 2009, consumer inflation net of impact of

indirect tax changes rising 2.5-3.9 percent year-on-year in

September 2008 and 2.6-4.0 percent in March 2009.

LINKS:

- For further details on November other past inflation data,

Reuters 3000 Xtra users can click on the Czech Statistical

Bureau's website:

http://www.czso.cz/eng/csu.nsf/kalendar/2004-ISC

- For LIVE Czech economic data releases, click on

- Instant Views on other Czech data [CZ/INSTANT]

- Overview of Czech macroeconomic indicators [CZ/ECI]

- Key data releases in central Europe [CEE-CONVERGENCE-WATCH]

- For Czech money markets data click on

- Czech money guide

- Czech benchmark state bond prices

- Czech forward money market rates

(Reporting by Marek Petrus; editing by Tony Austin)

Keywords: CZECH ECONOMY/INFLATION

[PRAGUE/Reuters/Finance.cz]

Elektromobilistům nastávají krušné časy. Elektromobily v mrazu ztrácejí až 40 % dojezdu a nabíjí se velmi pomalu

Elektromobilistům nastávají krušné časy. Elektromobily v mrazu ztrácejí až 40 % dojezdu a nabíjí se velmi pomalu

Test Seat Ateca: Zlaté staré časy aneb jistota v rozbouřených vodách a za dobrou cenu

Test Seat Ateca: Zlaté staré časy aneb jistota v rozbouřených vodách a za dobrou cenu

Šidit, svařovat totálky, kitovat a stáčet tachometry aneb v kůži polského autobazaru. Vyzkoušet pochybné praktiky si teď může každý

Šidit, svařovat totálky, kitovat a stáčet tachometry aneb v kůži polského autobazaru. Vyzkoušet pochybné praktiky si teď může každý

Řidiči, držte si klobouky. V nadcházejícím roce se změní řada věcí. Víme, které to budou

Řidiči, držte si klobouky. V nadcházejícím roce se změní řada věcí. Víme, které to budou

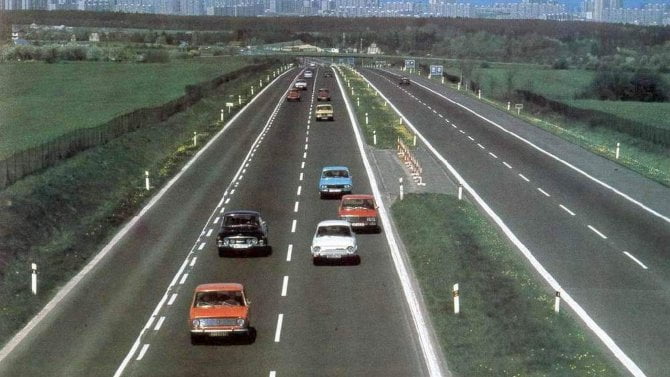

Až budete stát v koloně na D1, můžete slavit. Dálniční propojení Prahy a Bratislavy se otevřelo před 45 lety

Až budete stát v koloně na D1, můžete slavit. Dálniční propojení Prahy a Bratislavy se otevřelo před 45 lety